Ihr Partner für deals fundraising börsengänge syndizierungen finanzierungen

.

Die intelligente Wahl.

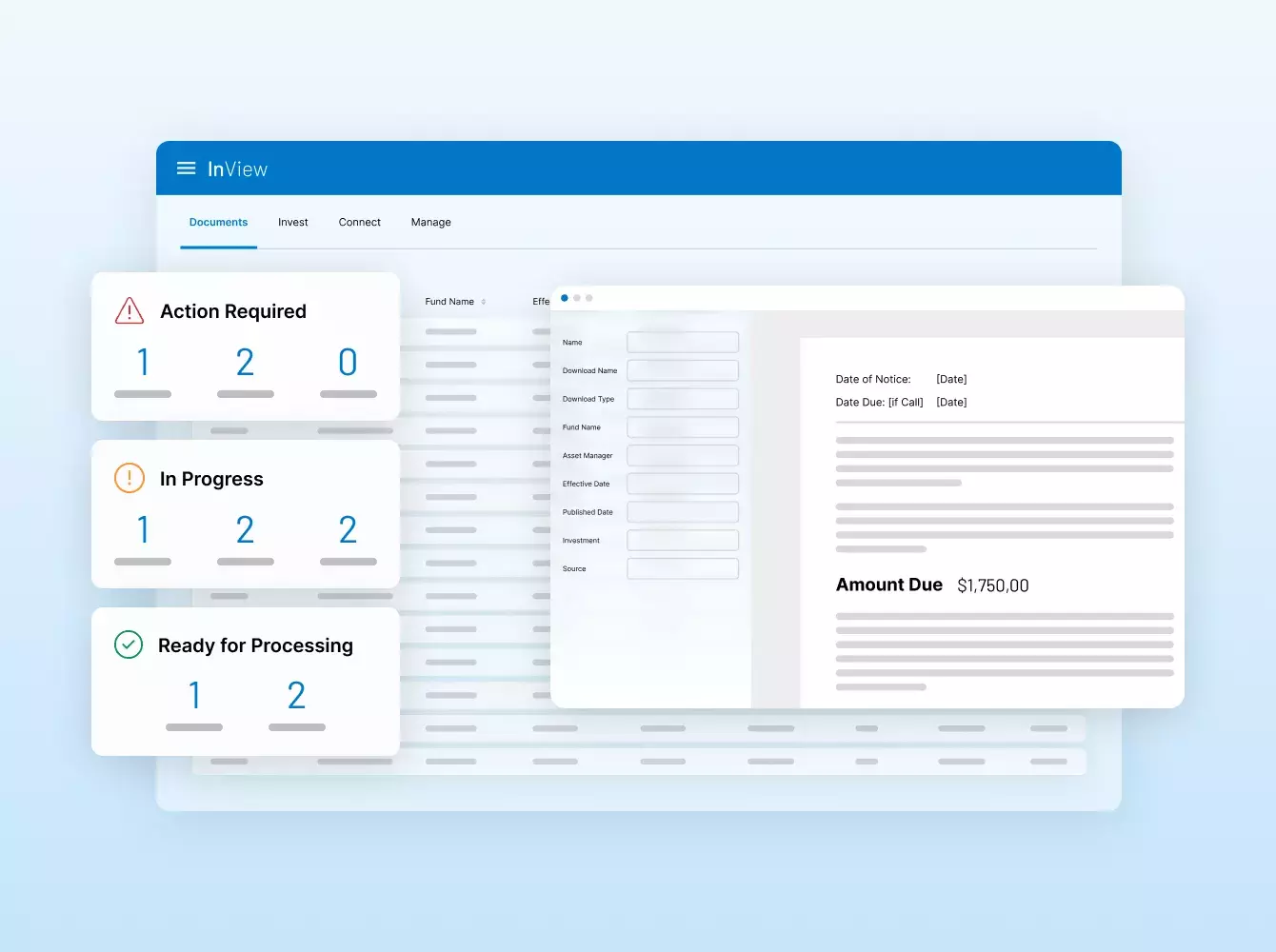

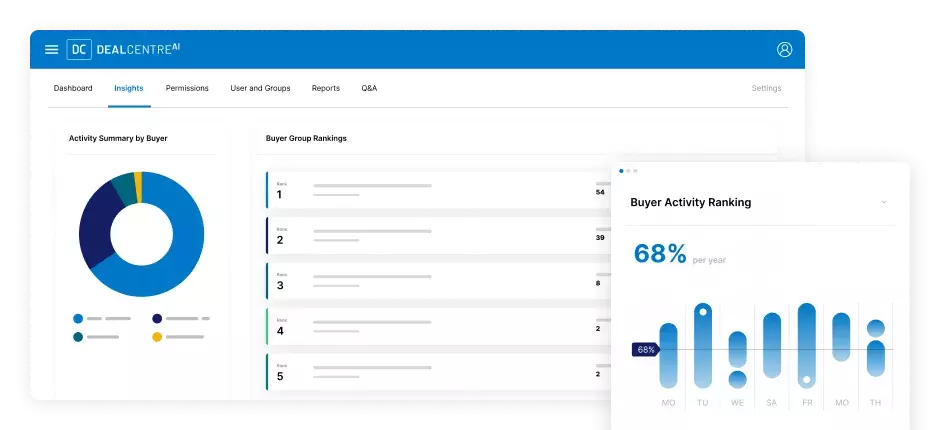

Unterstützen Sie Ihre strategischen Finanzgeschäfte mit unübertroffener Sicherheit und Effizienz – von virtuellen M&A-Datenräumen und Konsortialkrediten bis hin zum Fundraising, Investoren-Onboarding, Fondsreporting und mehr.

Vertrauensvoller Partner von Fortune-500-Unternehmen und der größten Market Maker

Raytheon

$ 89,8 Mrd.

SS&C Intralinks ermöglichte die Akquisition von Raytheon durch United Technologies für 89,8 Milliarden $.

Dow

$ 57,3 Mrd.

SS&C Intralinks ermöglichte das Spin-off von Dow Holdings Inc. an die Aktionäre im Wert von 57,3 Milliarden $.

Anaplan

$ 10,3 Mrd.

SS&C Intralinks ermöglichte die Übernahme von Anaplan durch Thoma Bravo für 10,3 Milliarden $.

Whole Foods

$ 13,6 Mrd.

SS&C Intralinks ermöglichte die Akquisition von Whole Foods durch Amazon für 13,6 Milliarden $.

Fortress

$ 3,3 Mrd.

SS&C Intralinks ermöglichte die Übernahme der Fortress Investment Group durch SoftBank für 3,3 Milliarden $.

TSG Consumer

$ 6 Mrd.

SS&C Intralinks ermöglichte das Fundraising für den TSG-Fonds TSG9, einen Buyout-Fonds mit Schwerpunkt auf dem Consumer-Bereich.

Neuberger Berman

$ 2,5 Mrd.

SS&C Intralinks ermöglichte das Fundraising für den NB Credit Opportunities Fund II von Neuberger.

Riverside

$ 1,87 Mrd.

SS&C Intralinks ermöglichte das Fundraising für den Micro-Cap Fund VI von Riverside.

Hayfin

$ 6,61 Mrd.

SS&C Intralinks ermöglichte das Fundraising für den Direct Lending Fund IV von Hayfin.

Summit Partners

$ 1,52 Mrd.

SS&C Intralinks ermöglichte das Fundraising für den Europe Growth Equity Fund IV von Summit Partners.

Summit Partners

$ 1,52 Mrd.

SS&C Intralinks ermöglichte das Fundraising für den Europe Growth Equity Fund IV von Summit Partners.

Der Finanztechnologie-Anbieter,

der weltweit das meiste Vertrauen genießt.

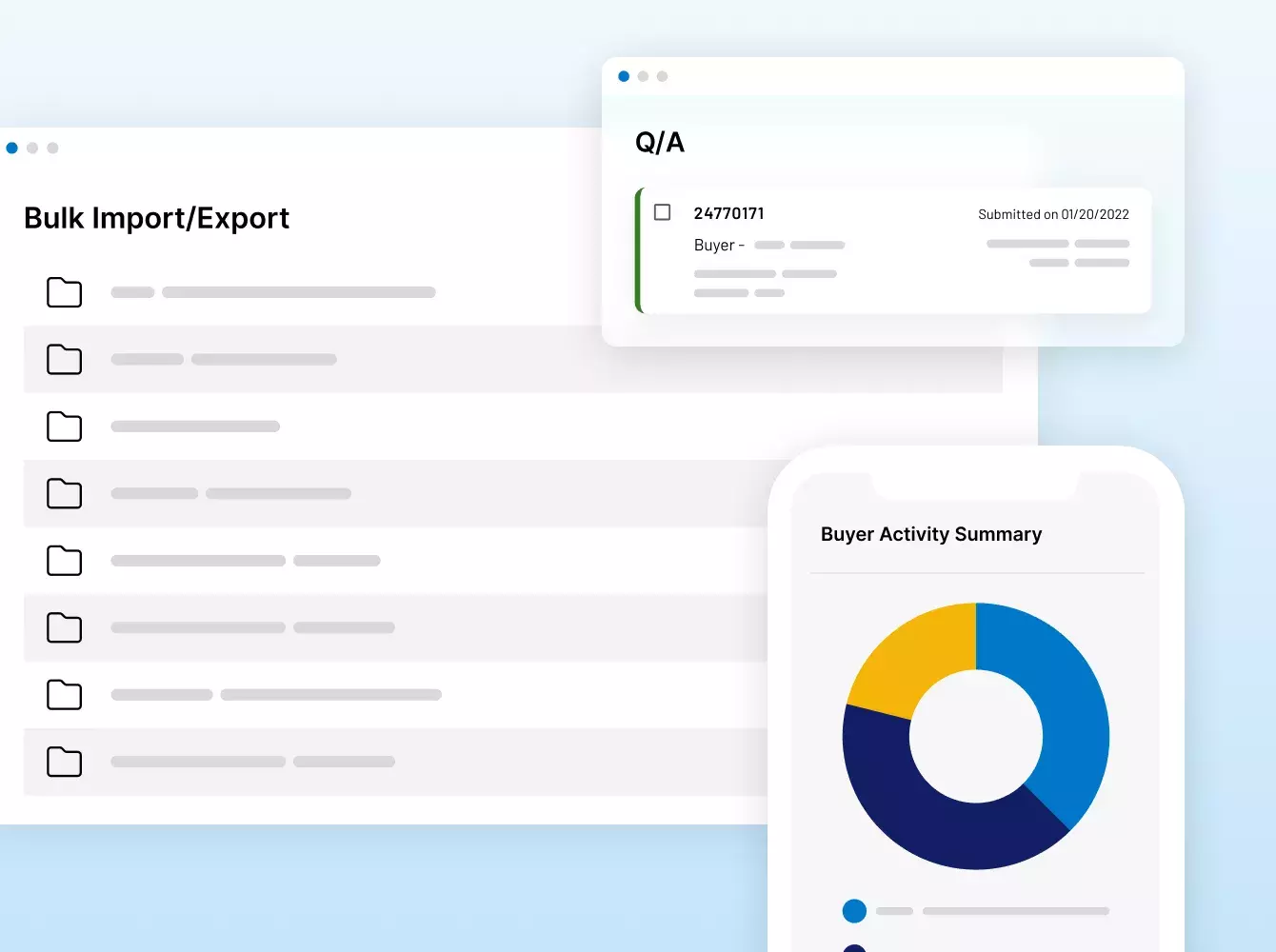

Als VDR-Vorreiter mit über 20 Jahren Erfahrung sind kontinuierliche Innovationen für Intralinks selbstverständlich. Unsere Lösungen ermöglichen die weltgrößten Kapitalmarktgeschäfte, damit General Partner (GP) für Limited Partner (LP) das Optimum erreichen können.

Kontakt aufnehmenDie Nr. 1 im M&A Bereich.

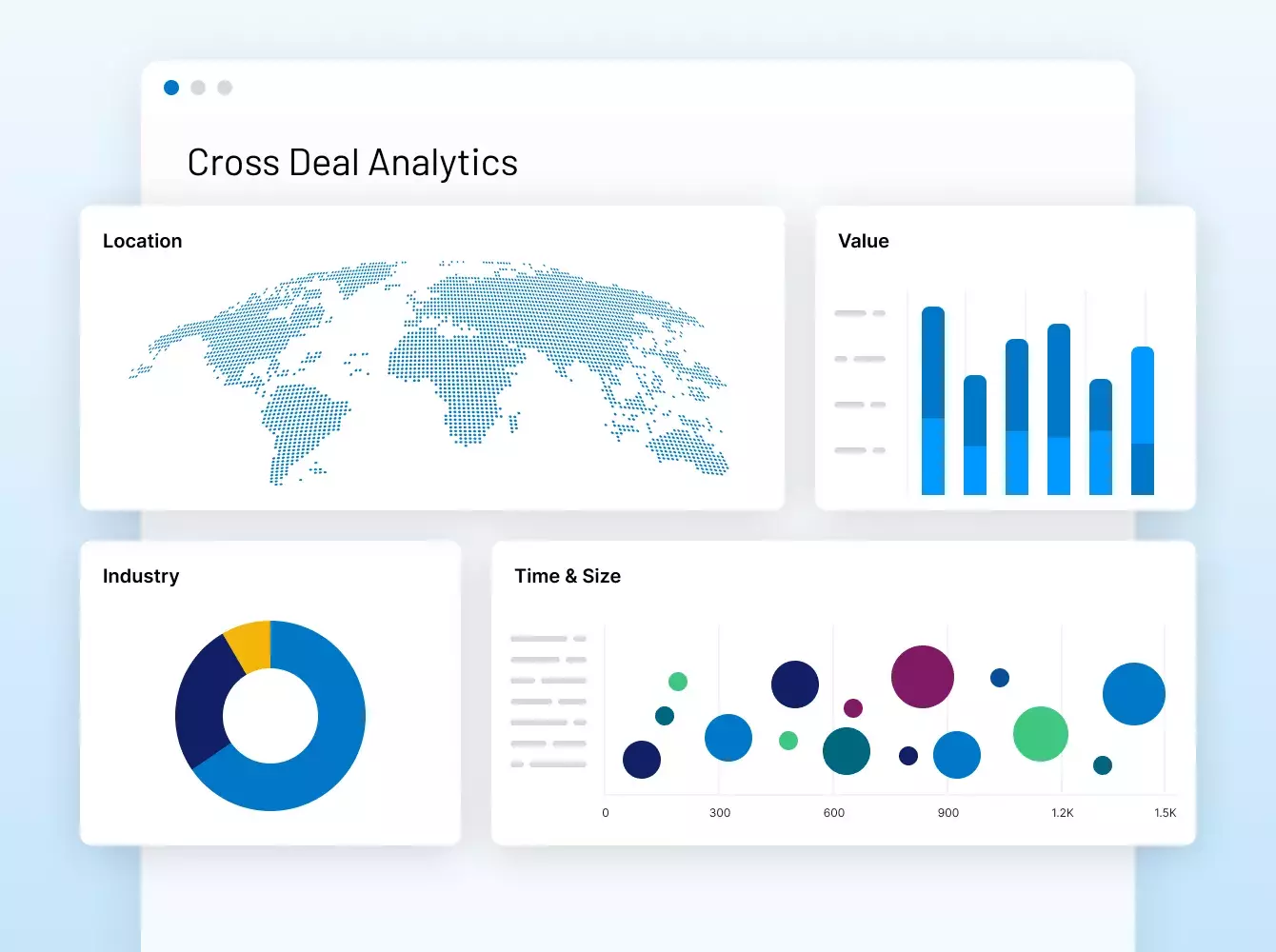

Deal-Lösungen für Finanztransaktionen von über 35 Billionen $

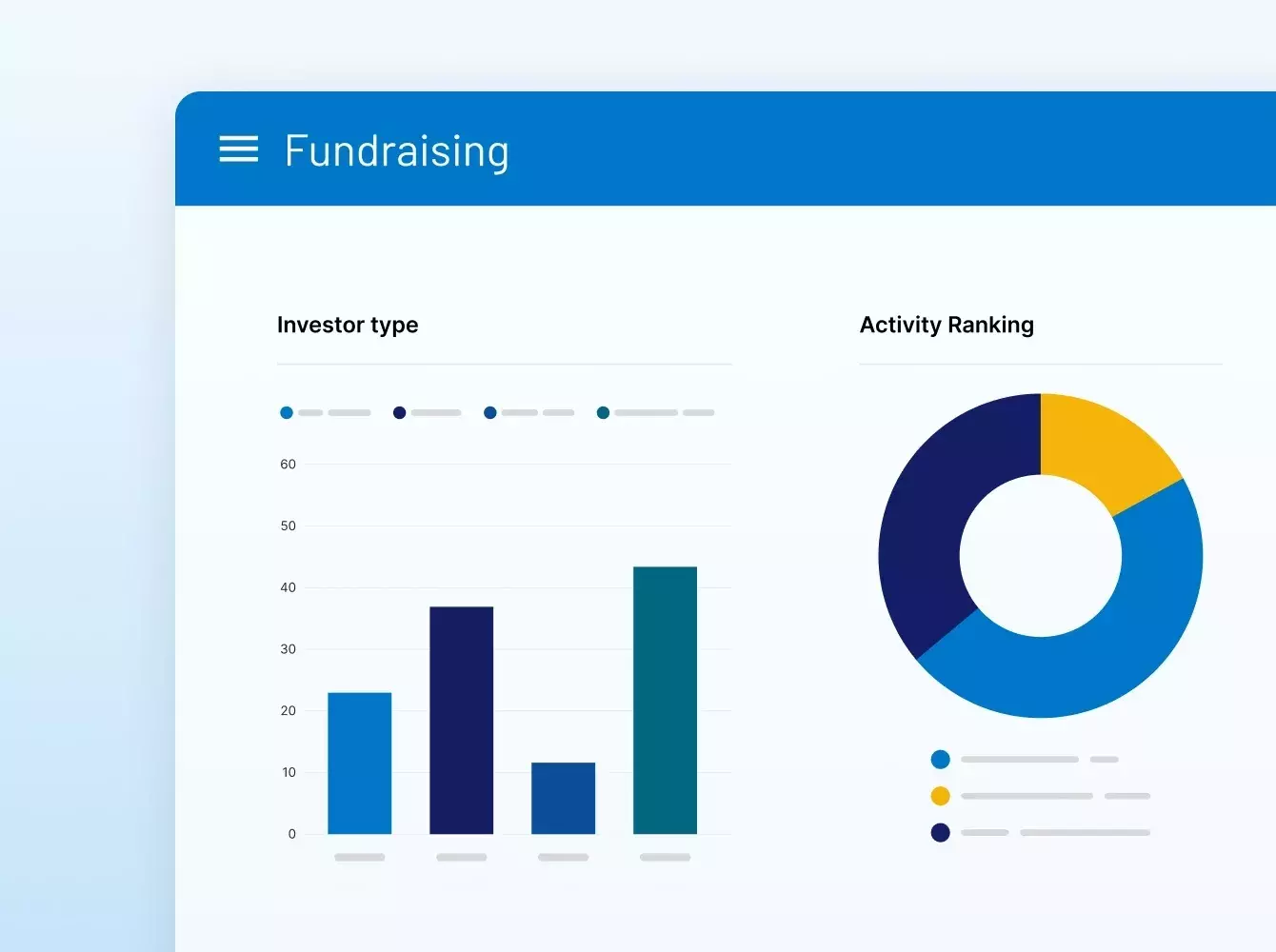

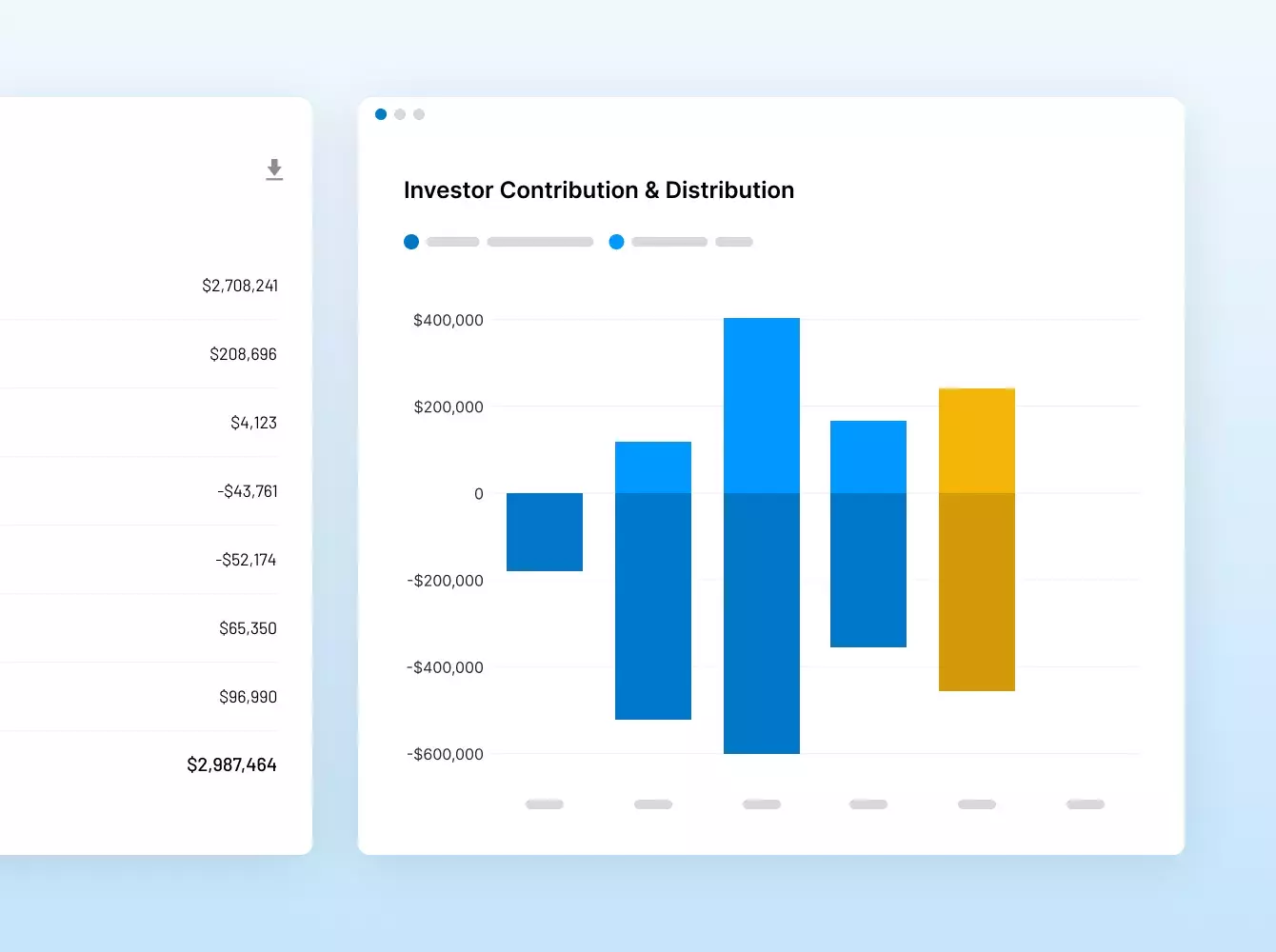

Die Nr. 1 bei GPs & LPs.

Community mit 515.000 Einzelpersonen aus über 100.000 Unternehmen

Die Nr. 1

unter den Fundraising-Plattformen

mit mehr als 1 $ gesicherter Mittel pro 2 $, die weltweit per Fundraising investiert wurden

Über 200 Mio. $

F&E-Investitionen in den vergangenen fünf Jahren

ISO 27701

Erster VDR-Anbieter mit der höchsten Datenschutz-Zertifizierung

Leader

IDC MarketScape: Worldwide Mergers and Acquisitions Software 2024 Vendor Assessment (Bewertung der Anbieter von Software für weltweite Fusionen und Akquisitionen 2024)

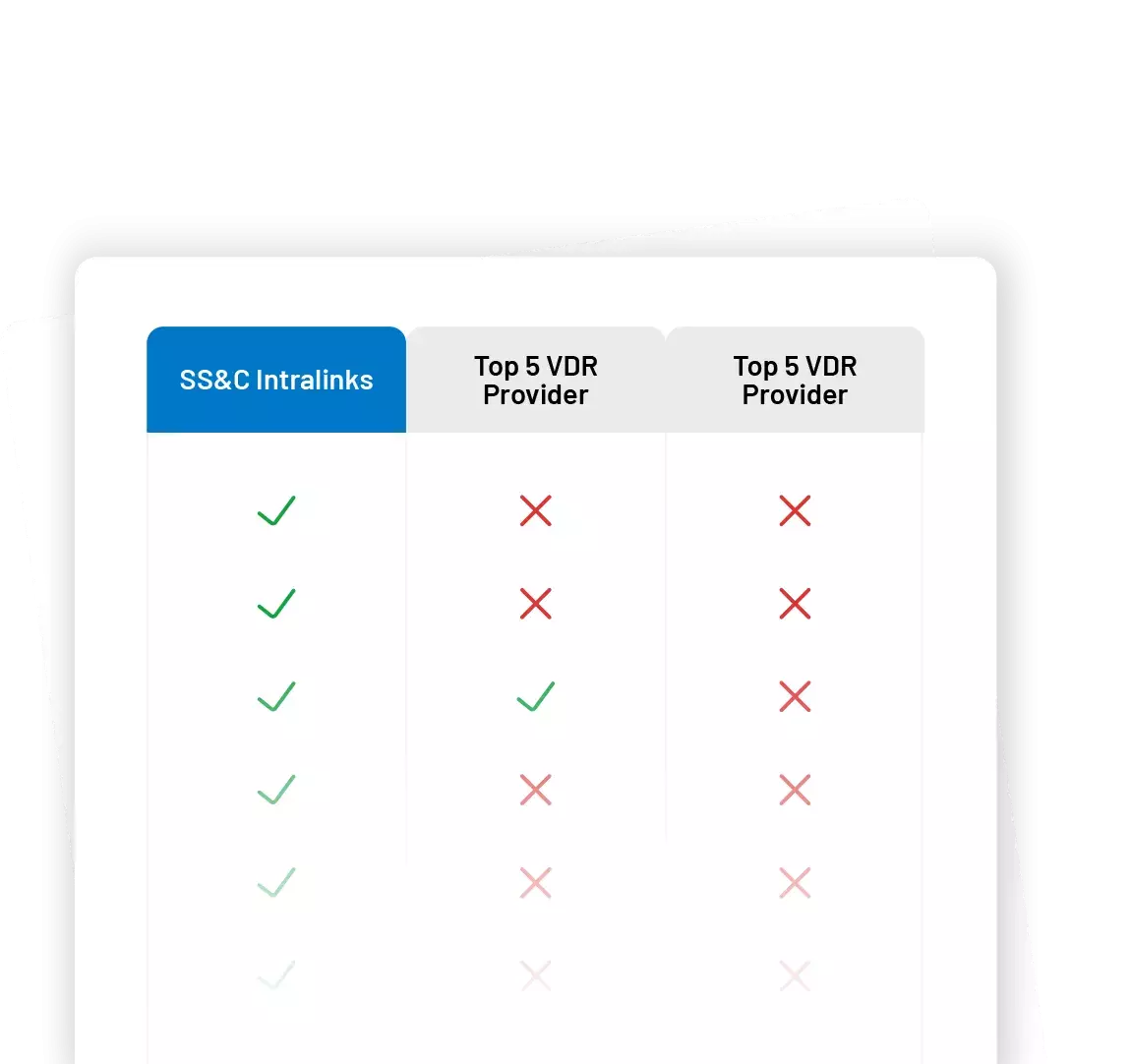

Sie müssen Ihren Kunden

zur Auswahl eines VDR beraten?

Als Berater müssen Sie Kunden häufig mehrere VDR-Alternativen zum Vergleich vorlegen. Um Ihnen Zeit zu sparen, haben wir eine Vorlage mit einem Funktionsvergleich der wichtigsten VDR-Anbieter erstellt.

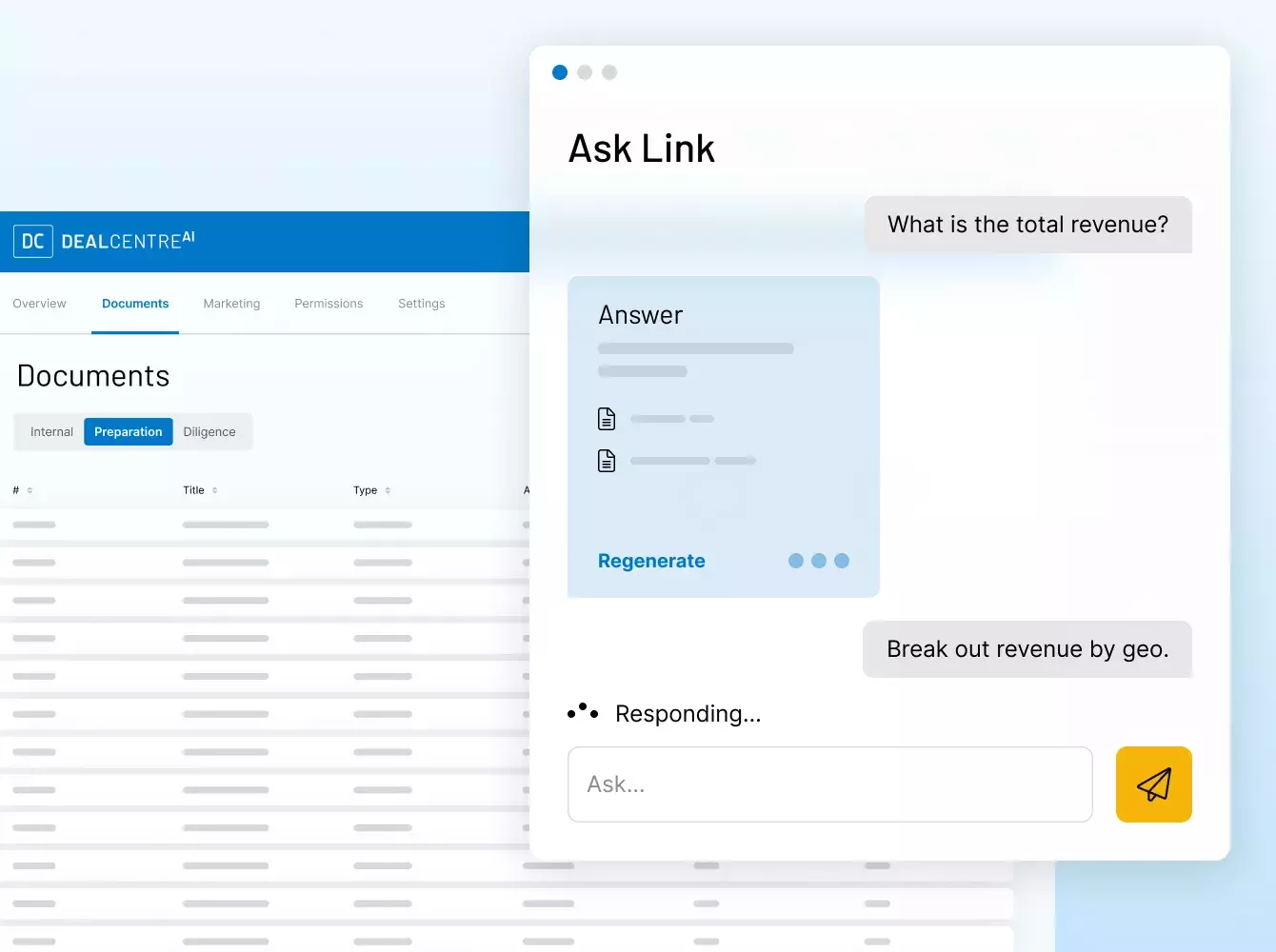

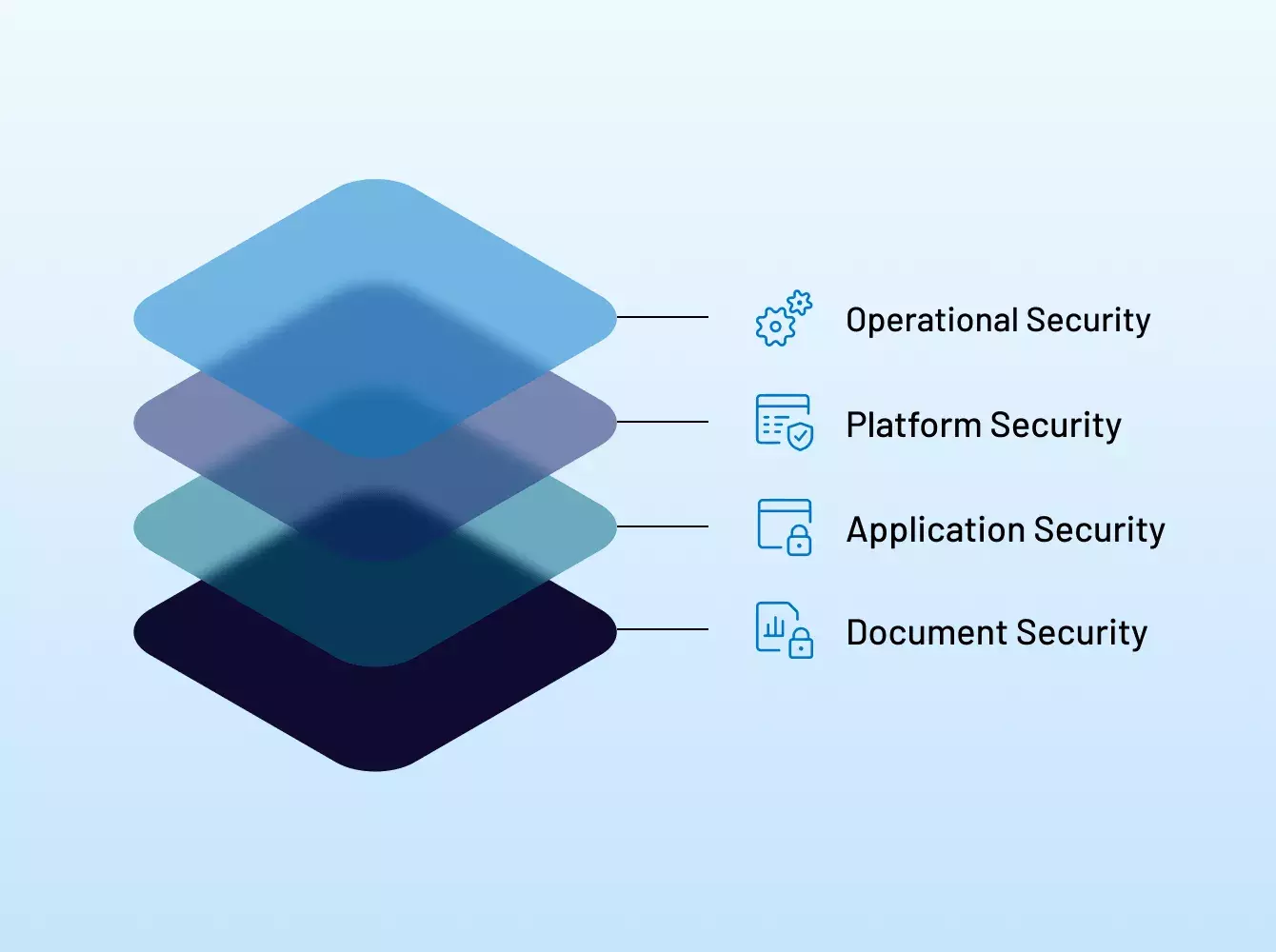

Warum brauche ich einen sicheren Ort für meine Daten?

Finanztransaktionen umfassen zahlreiche Dokumente, von denen viele vertraulich sind und sensible Informationen enthalten. Die Wahl eines vertrauenswürdigen, bewährten Anbieters ist deshalb entscheidend. Mit Intralinks schützen Sie Ihre Deals und Daten durch ein Ökosystem, bei dem die Sicherheit an erster Stelle steht – für Sie, Ihre Kunden und Ihre Partner.

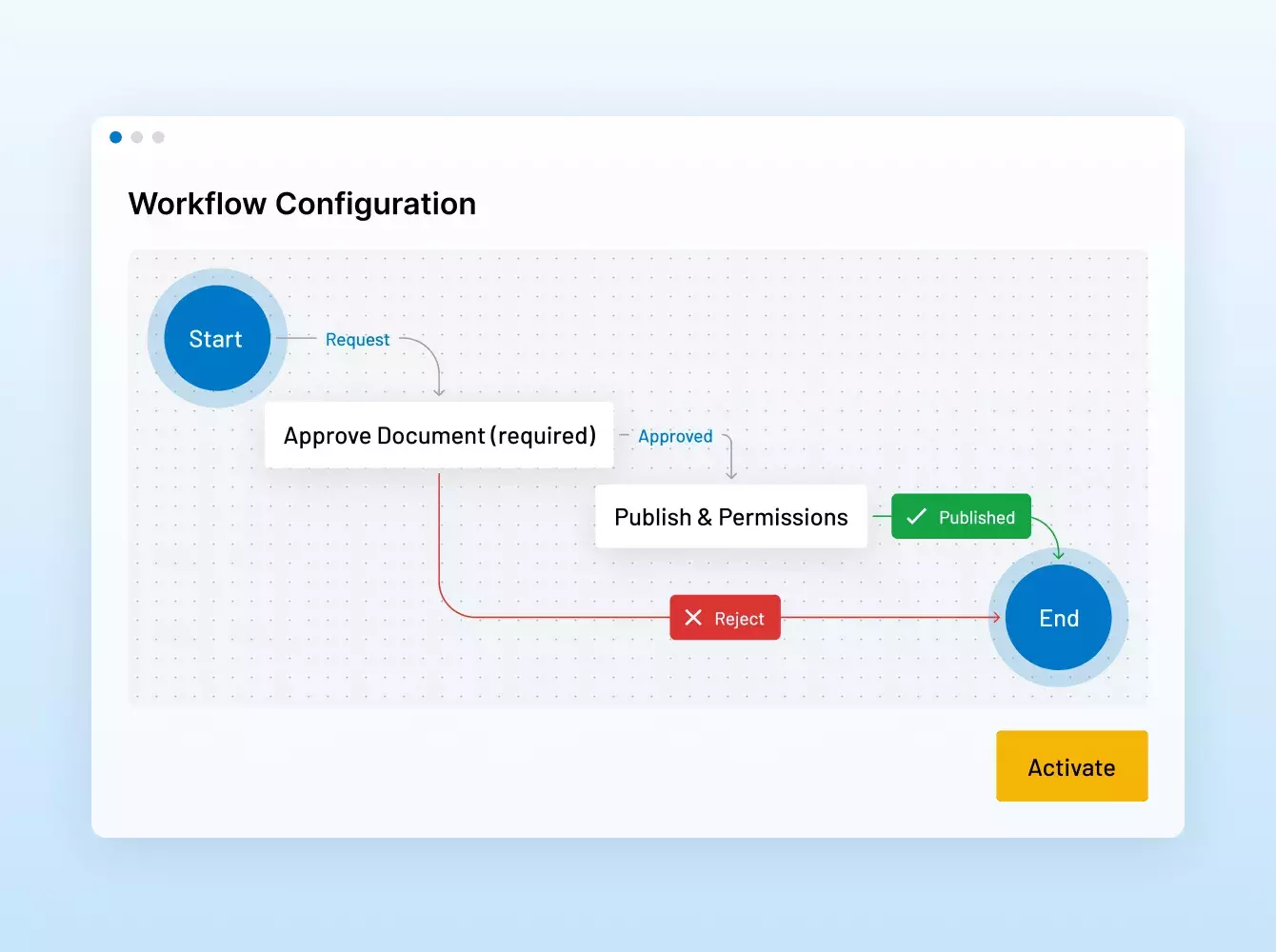

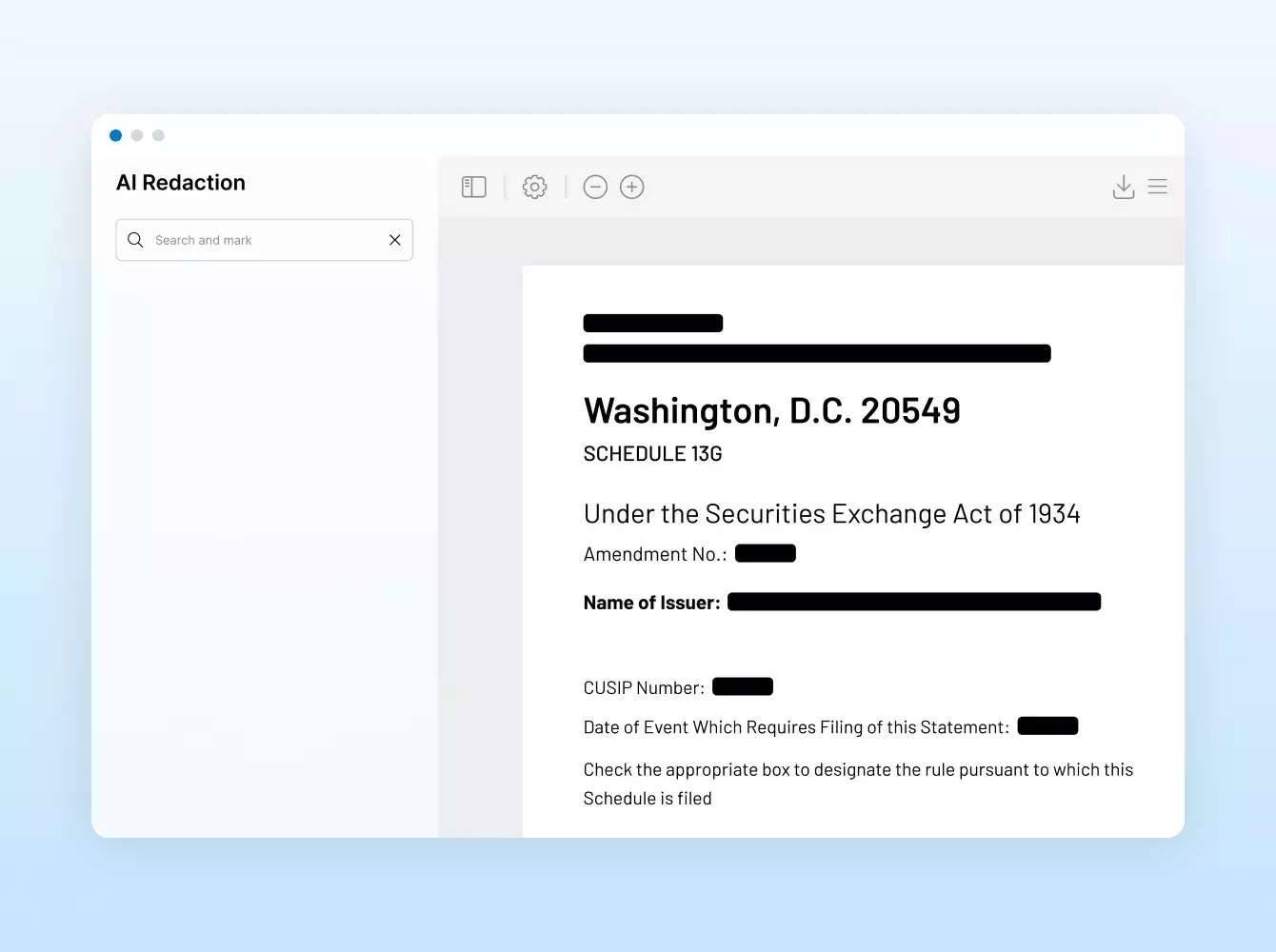

Welche Zusatzleistungen bieten Sie an?

Ob Kunden taktische Unterstützung bei der VDR-Einrichtung, zusätzliche Ressourcen für aufwendige Aufgaben wie Schwärzungen oder Geheimhaltungsvereinbarungen oder eine individuelle Komplettlösung mit Automatisierung und komplexen Integrationen benötigen – die Services-Teams von Intralinks sind für Sie da. Unser Leistungsangebot vereint unsere bahnbrechende Technologie, Branchenexpertise und jahrzehntelange Erfahrung, um alle Anforderungen in jeder Deal- oder Projektphase zu erfüllen.

Warum sind Sie die bessere Wahl als andere Anbieter?

Intralinks ist ein Vorreiter bei virtuellen Datenräumen (VDR). Mit unseren speziell entwickelten Lösungen und einer banksicheren Sicherheit, die Daten und den Ruf des Unternehmens schützt, profitieren unsere Kunden kontinuierlich von Verbesserungen bei ihren Arbeitsweisen. Hinter uns steht SS&C, ein leistungsstarkes Fintech-Unternehmen mit einem Umsatz von über 6 Milliarden $. Im Gegensatz zu anderen Anbietern, die im F&E-Bereich und bei Services sparen, investieren wir über einen Zeitraum von fünf Jahren 200 Millionen $ in ein erstklassiges Kundenerlebnis.

Sind andere Filesharing-Lösungen nicht genauso sicher?

Nein. Andere Anbieter bezeichnen sich zwar als sicher, verwenden aber häufig vage und irreführende Formulierungen, die de facto keinen konkreten Nachweis der Sicherheit liefern. Unser umfassender Sicherheitsansatz umfasst branchenführende Zertifizierungen und bewährte Compliance-Methoden für alle Aspekte, die Mitarbeiter, Prozesse, Richtlinien und die unterstützende Infrastruktur von Intralinks betreffen.

Der nächste Schritt

- Branchenführende Sicherheit

- Weltweite Reichweite und Zuverlässigkeit

- Vielseitige und benutzerfreundliche Lösungen

- Best-in-class-Support