딜자금조달 IPO 신디케이션 파이낸싱

이 이루어지는 곳입니다.

뛰어납니다.

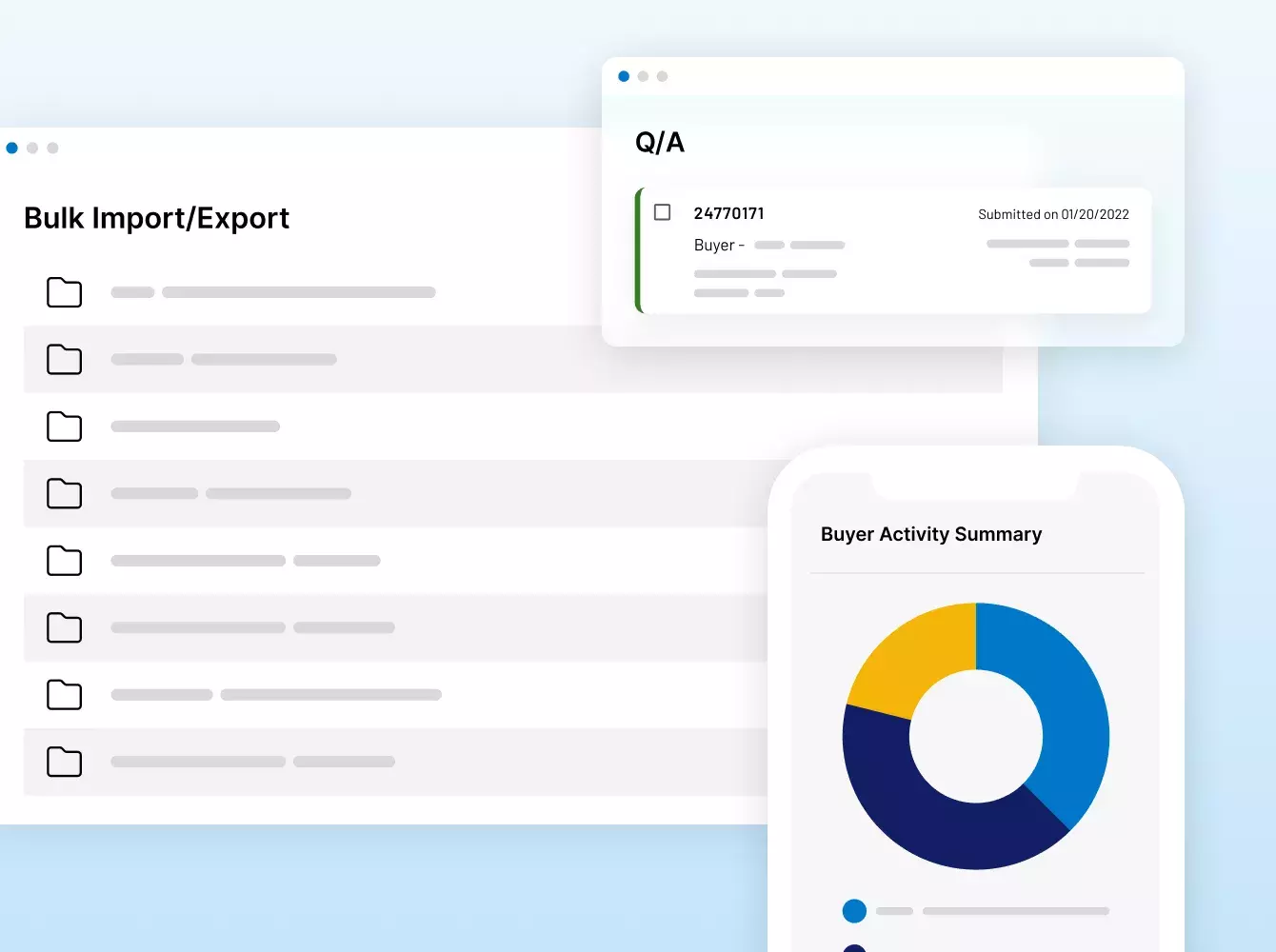

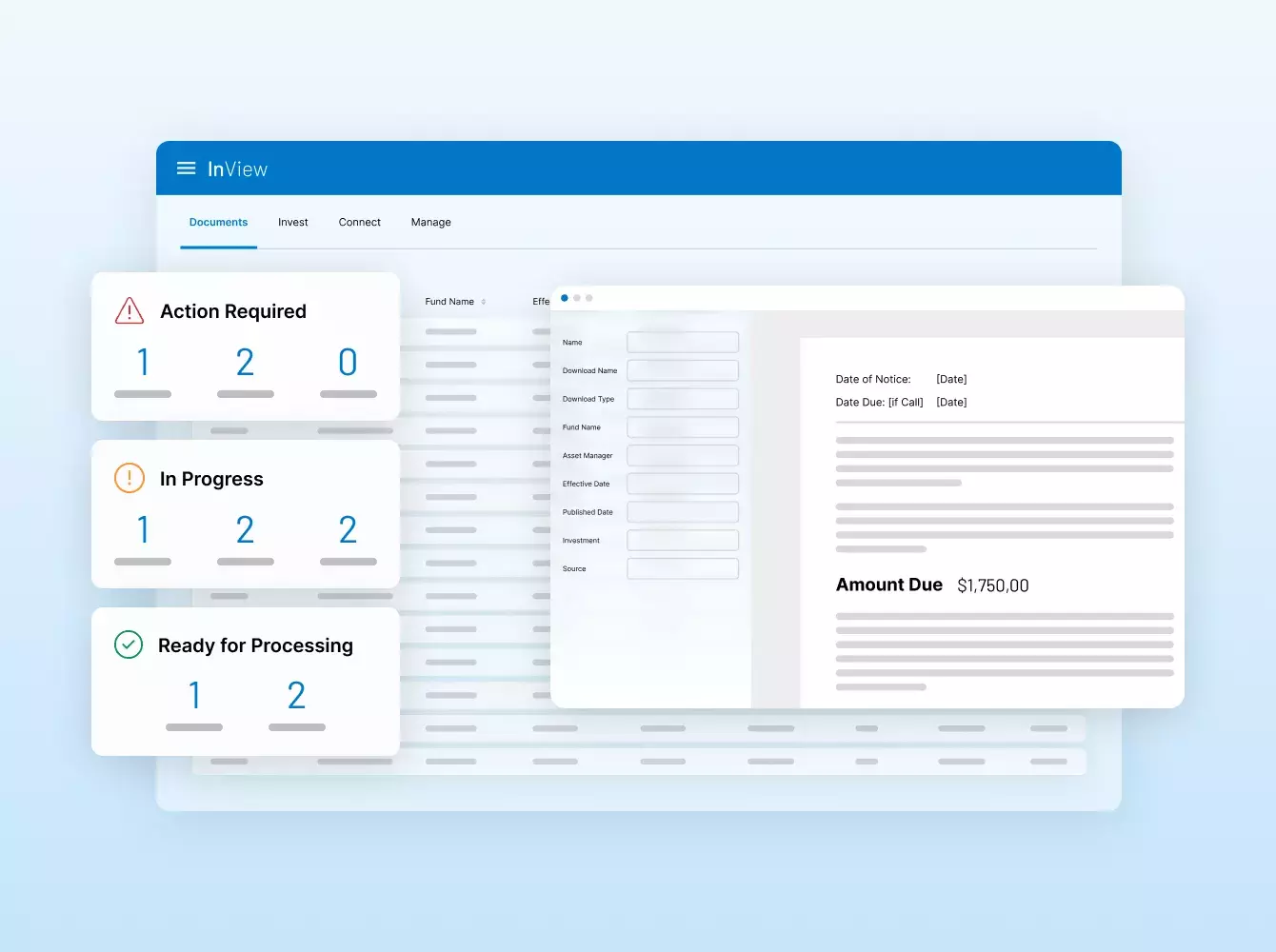

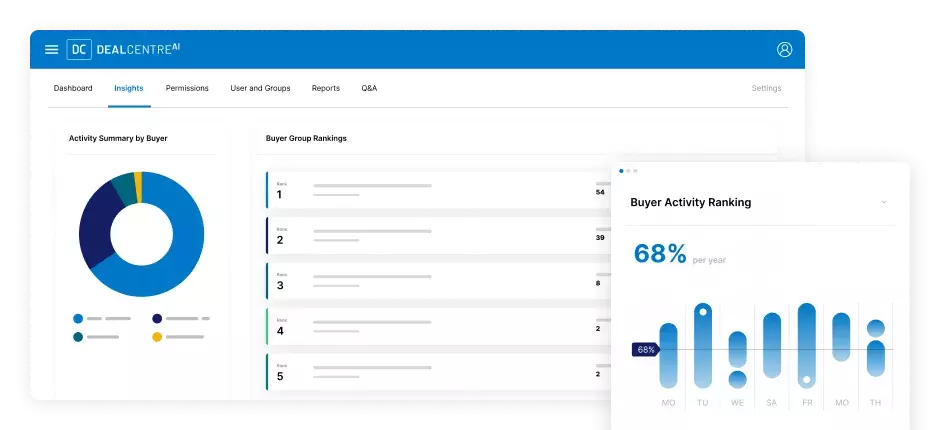

M&A 가상 데이터룸 및 신디케이트 대출부터 펀드 모집, 투자자 온보딩, 펀드 리포팅 등에 이르기까지 탁월한 보안 및 효율성으로 전략적 금융 거래를 지원합니다.

Fortune 500 및 최대 투자 전문 기관의 신뢰를 받습니다

Raytheon

$ 898억

SS&C Intralinks는 United Technologies가 898억 달러에 Raytheon를 순조롭게 인수하도록 했습니다.

Dow

$ 573억

SS&C Intralinks는 Dow Holdings Inc의 573억 달러를 주주들에게 분할하는 것을 순조롭게 진행했습니다.

Anaplan

$ 103억

SS&C Intralinks는 Thoma Bravo가 103억 달러에 Anaplan을 순조롭게 인수하도록 했습니다.

Whole Foods

$ 136억

SS&C Intralinks는 Amazon이 136억 달러에 Whole Foods를 순조롭게 인수하도록 했습니다.

Fortress

$ 33억

SS&C Intralinks는 SoftBank가 33억 달러에 Fortress Investment Group을 순조롭게 인수하도록 했습니다.

TSG 소비자

$ 60억

SS&C Intralinks는 소비자 섹터에 초점을 둔 바이아웃 펀드인 TSG의 펀드 TSG9에 대한 자금조달을 원활하게 진행했습니다.

Neuberger Berman

$ 25억

SS&C Intralinks는 Neuberger의 NB Credit Opportunities Fund II에 대한 자금조달을 원활하게 진행했습니다.

Riverside

$ 18억 7천만

SS&C Intralinks는 Riverside의 Micro-Cap Fund VI에 대한 자금 조달을 원활하게 진행했습니다.

Hayfin

$ 66억 1천만

SS&C Intralinks는 Hayfin의 Direct Lending Fund IV에 대한 자금조달을 원활하게 진행했습니다.

Summit Partners

$ 15억 2천만

SS&C는 Summit Partner의 Europe Growth Equity Fund IV에 대한 자금조달을 원활하게 진행했습니다.

Summit Partners

$ 15억 2천만

SS&C는 Summit Partner의 Europe Growth Equity Fund IV에 대한 자금조달을 원활하게 진행했습니다.

세계적으로 신뢰할 수 있는

금융 테크놀로지 공급자.

Intralinks는 20여년 전 VDR시장을 개척했으며, 그 이후에도 계속해서 혁신을 이어가고 있습니다. 당사의 솔루션은 세계 최대의 자본 시장 거래를 지원하고 투자 운용사(GP)가 세계적인 수준의 투자자(LP) 경험을 제공할 수 있도록 합니다.

문의하기#1 M&A

35조 달러 이상의 금융 거래에 대한딜 솔루션

#1투자 운용사 (GP)- 투자자 (LP)

100,000개 이상 조직의 개인 515,000명이 있는 커뮤니티

#1

자금조달 플랫폼

전 세계적으로 모금되는 2달러중

1달러 이상

$2억 이상

지난 5년 동안 R&D 투자

ISO-27701

가장 높은 데이터 개인정보 보호

인증을 획득한 최초의 VDR 공급업체

6

상을 받은 지원팀에 연락하는 데

걸리는 평균 시간. 단 몇 초

고객에게 조언해야 합니다

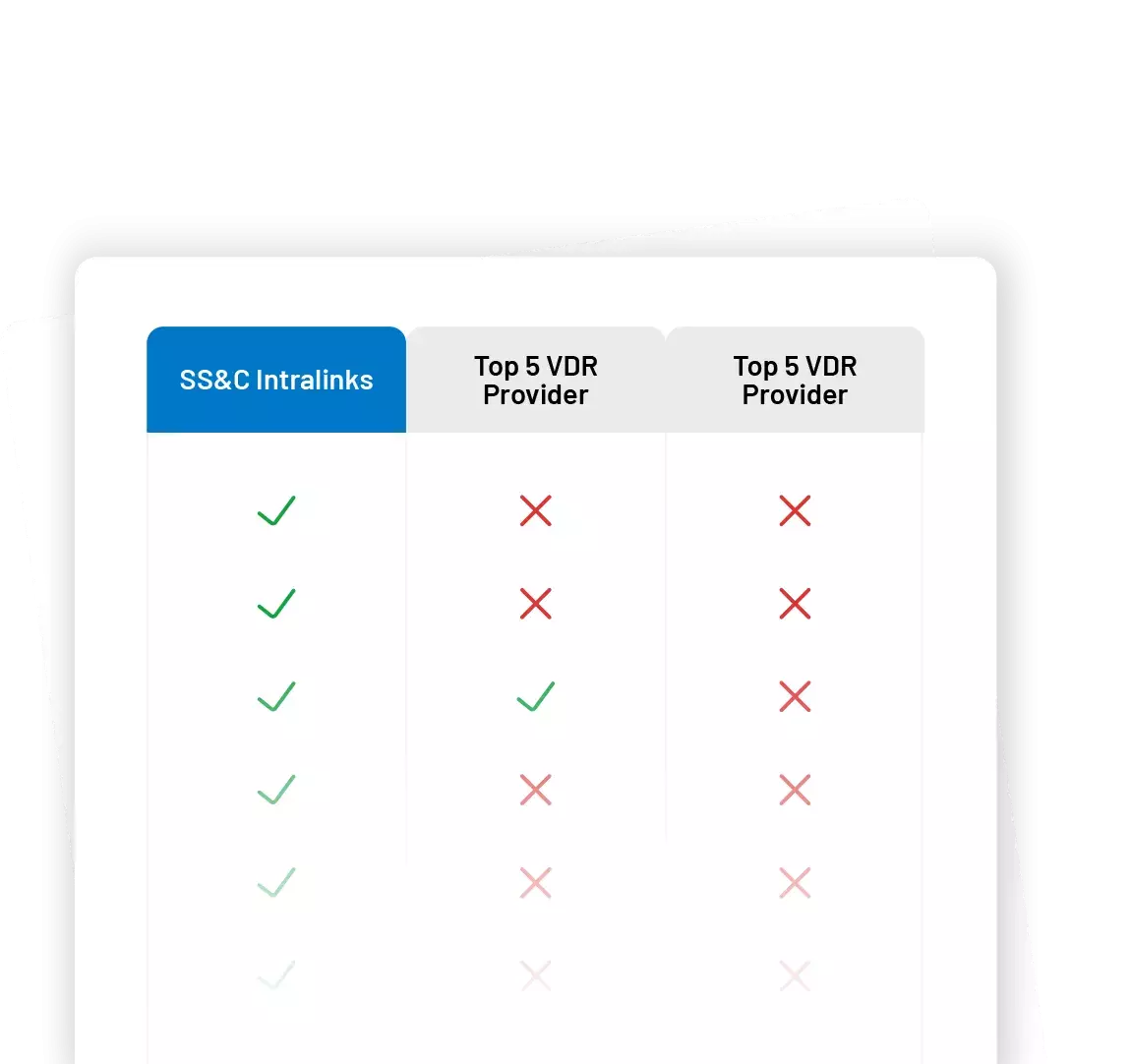

VDR을 선택하는 방법은?

자문사는 종종 VDR 대안에 대한 비교를 고객에게 제시해야 합니다. 시간을 절약해 드리고자 당사는 상위 VDR 제공자 간 기능 비교를 포함하는 템플릿을 만들었습니다.

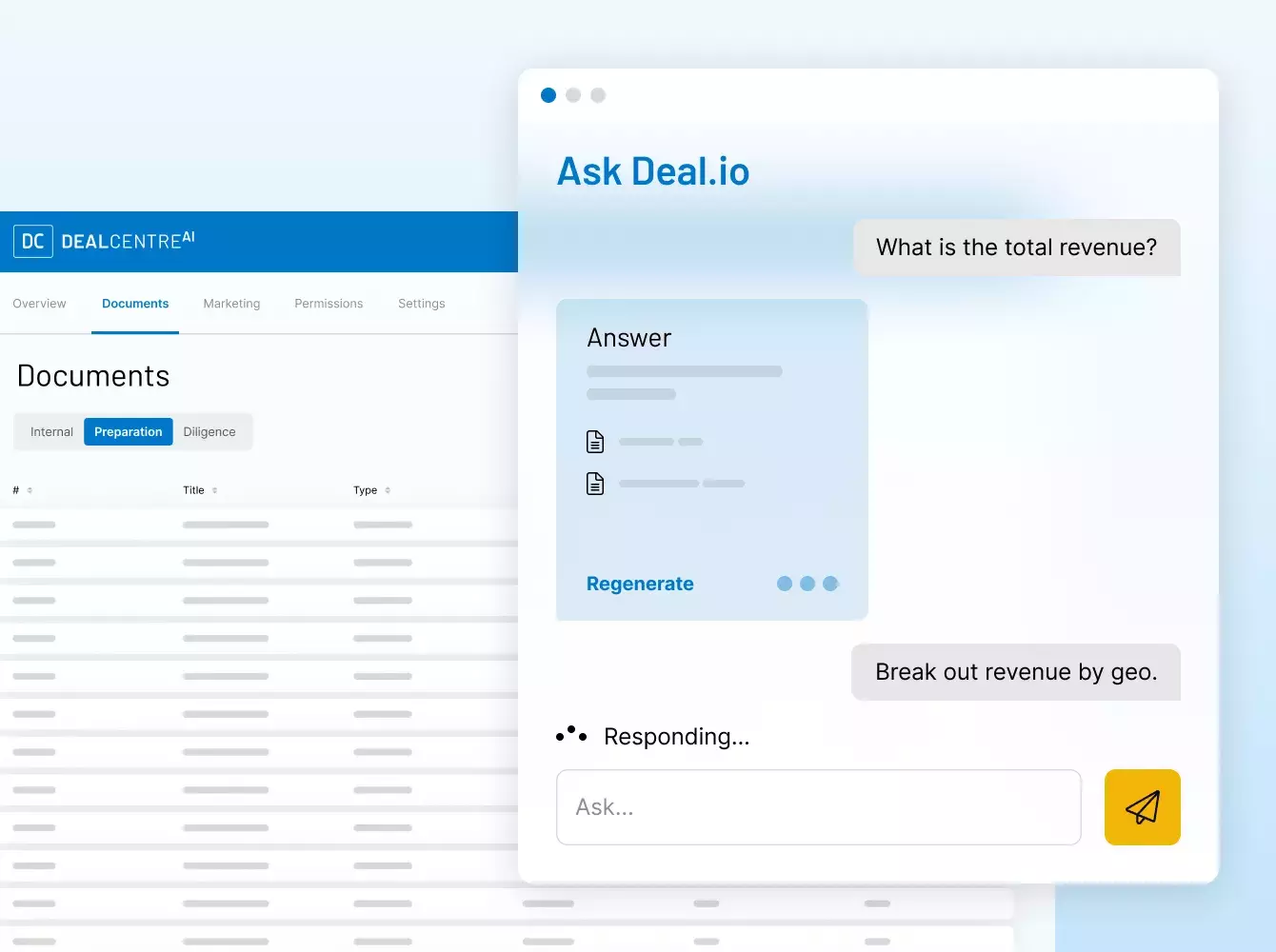

제 데이터를 위해 안전한 장소가 필요한 이유는 무엇인가요?

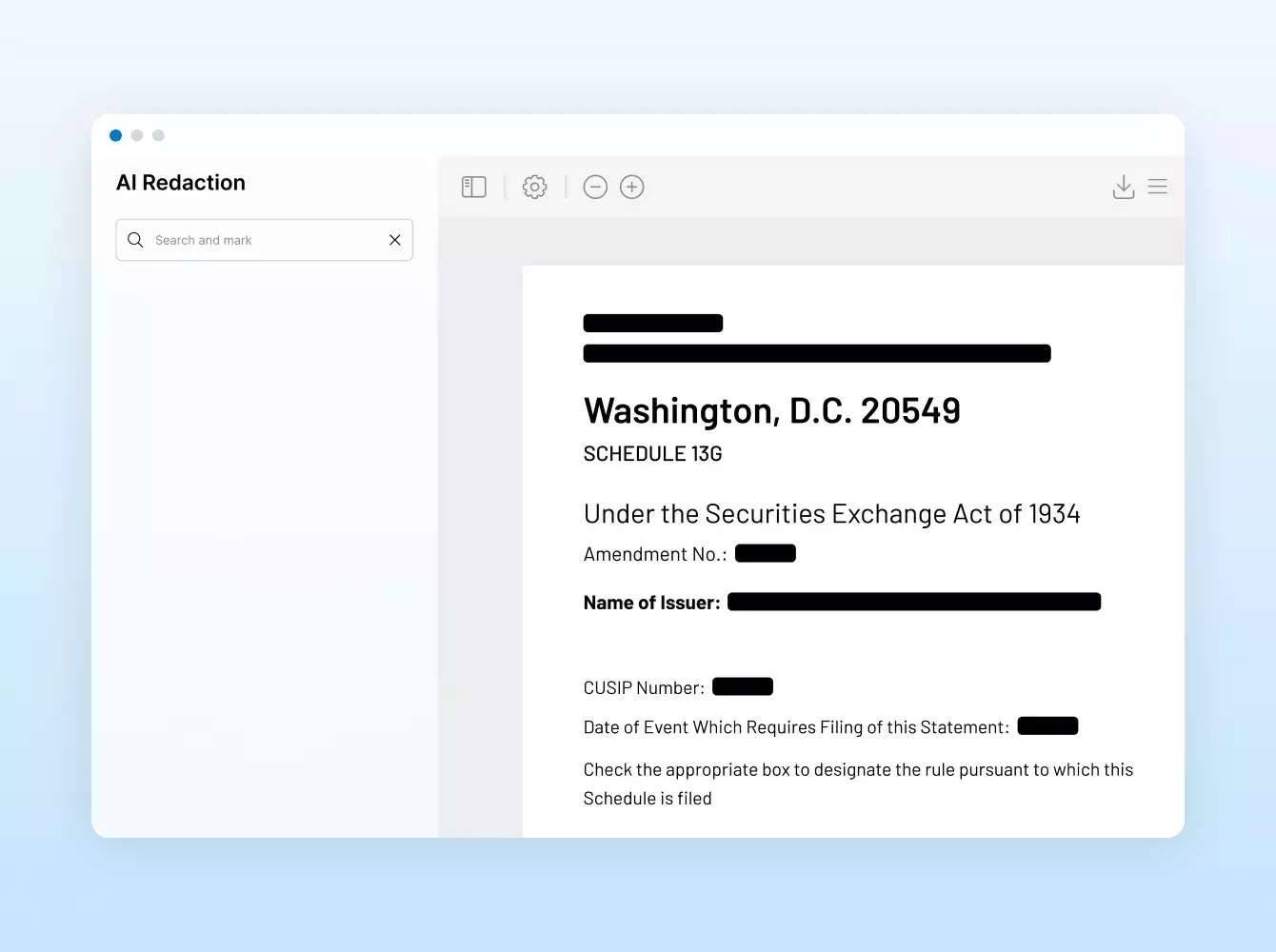

금융 거래는 수많은 문서가 관련되며, 그 중 다수의 문서는 기밀이고 민감한 정보를 포함합니다. 신뢰할 수 있고 검증된 제공자 선택은 매우중요합니다. Intralinks에서 당사의 사명은 귀하, 귀하의 고객, 귀하의 파트너를 위한 보안에 전념하는 생태계를 통해 귀하의 딜 및 데이터를 보호하는 것입니다.

추가적으로 어떤 서비스를 제공하나요?

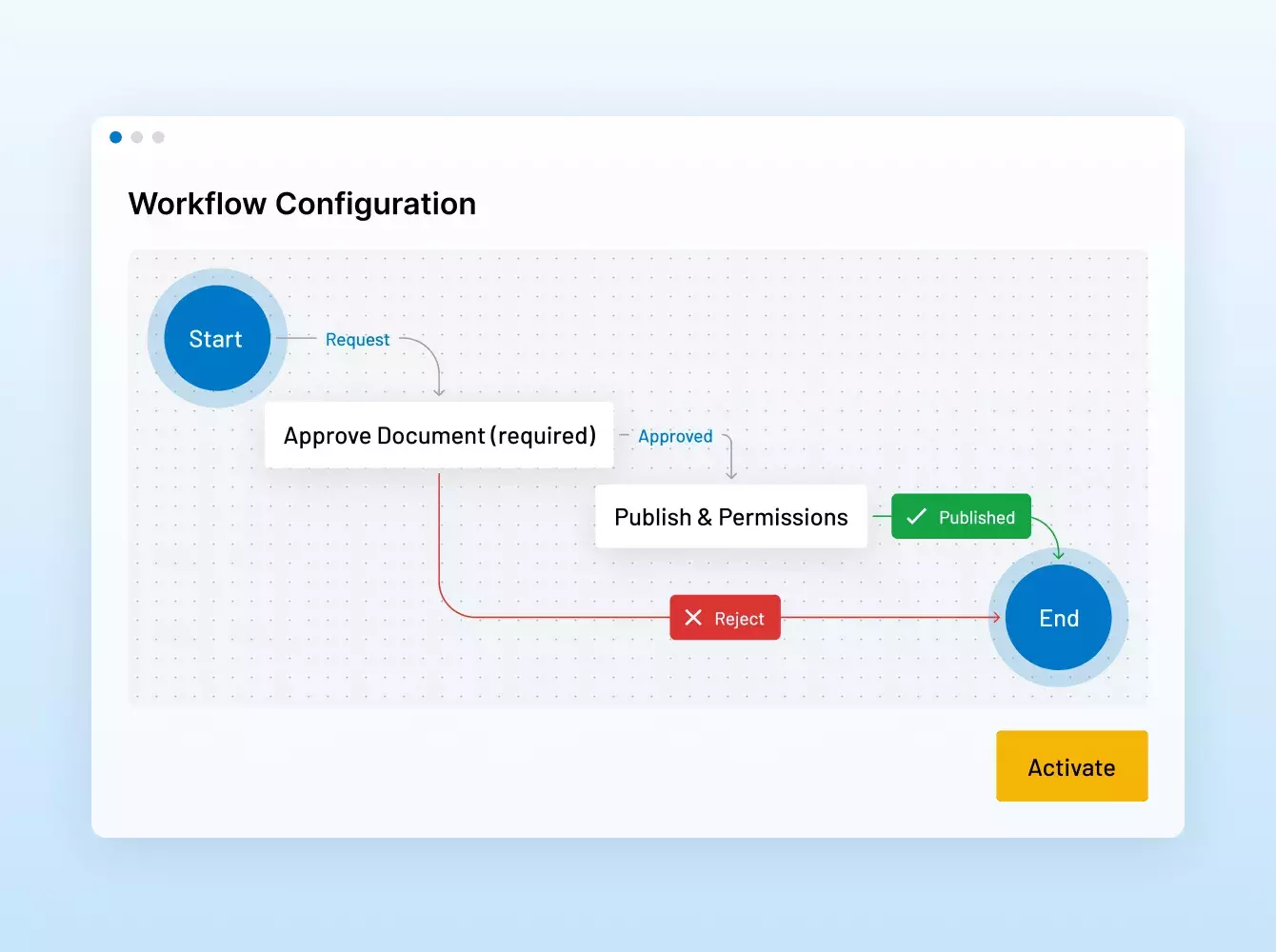

고객이 VDR 설정을 위한 전략적 지원, 리댁션 또는 NDA와 같은 비핵심 작업에 대한 추가 리소스, 자동화 및 복잡한 통합을 통한 완전히 맞춤화된 솔루션을 필요로 하는지 여부와 상관없이 Intralinks의 서비스팀은 도울 준비가 되어 있습니다. 당사는 선구적인 기술, 업계 전문 지식 및 수십 년의 경험을 결합하여 딜 또는 프로젝트의 모든 단계에서 어떠한 요구 사항이던 만족시키는 서비스를 제공합니다.

귀사가 다른 제공자보다 더 나은 선택인 이유는 무엇인가요?

Intralinks는 가상 데이터 룸(VDR) 분야의 선구자로서, 맞춤형 솔루션과 은행 수준의 보안을 통해 고객의 작업 방식을 지속적으로 혁신하여 데이터와 평판을 보호합니다. 당사는 60억 달러 이상의 매출을 올리는 강력한 핀테크 기업인 SS&C의 지원을 받습니다. 경쟁사들이 R&D와 서비스를 축소하는 동안, 당사는 5년 동안 2억 달러 이상을 할당하여 계속 투자하여 고객에게 세계적인 수준의 경험을 제공합니다.

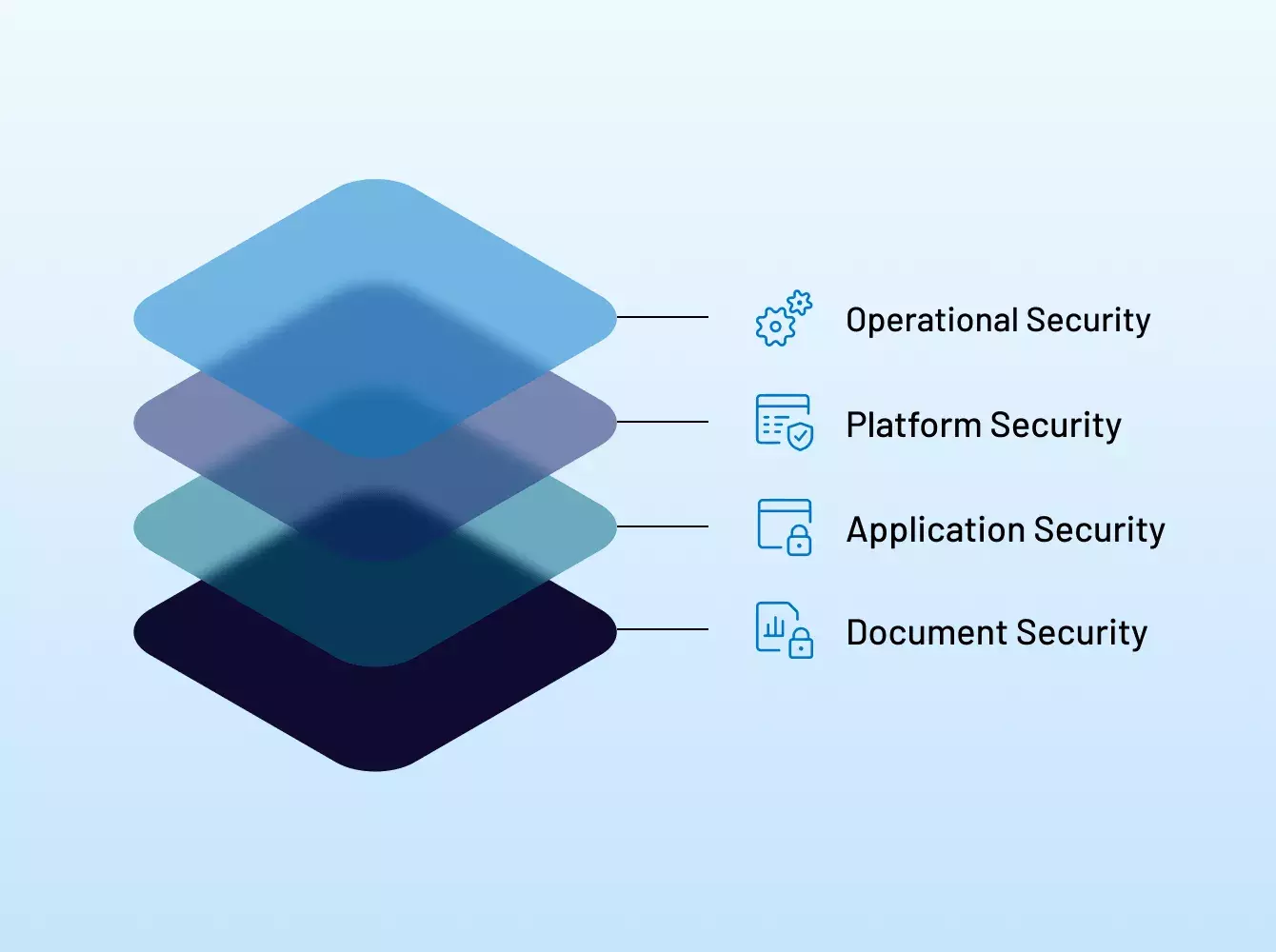

다른 파일 공유 솔루션도 마찬가지로 안전하지 않나요?

아닙니다. 다른 제공자들이 안전하다고 주장하지만, 많은 제공자들이 의도적으로 모호하고 오해의 소지가 있는 언어를 사용하여 진정한 보안 자격증을 감춥니다. 당사의 포괄적인 보안 접근 방식은 Intralinks 종사자, 프로세스, 정책 및 지원 인프라의 모든 측면에 걸친 업계를 선도하는 인증 및 규정 준수 모범 사례를 포함합니다.